XRP Price Prediction: $5 Target in Sight as Technicals and Fundamentals Align

#XRP

- Technical Breakout: XRP trading above key moving averages with Bollinger Band squeeze suggesting volatility expansion

- Regulatory Catalyst: RLUSD stablecoin approval offsets ETF delay concerns

- On-Charm Metrics: DeFi yield opportunities increasing retail holder participation

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Despite Short-Term Volatility

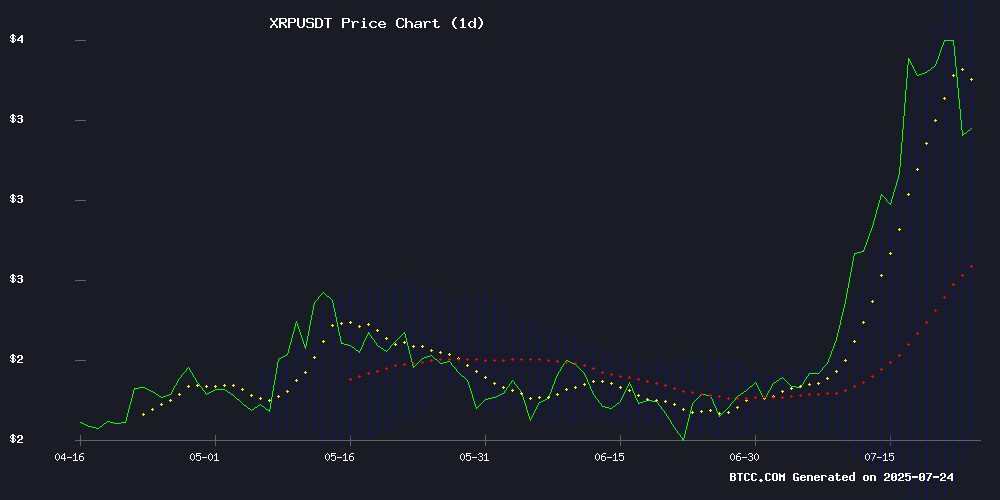

XRP is currently trading at, above its 20-day moving average of 2.9268, indicating potential bullish momentum. The MACD histogram shows narrowing bearish divergence (-0.0988), while price sits comfortably between Bollinger Band support (2.0035) and resistance (3.8500).

"The technical setup suggests accumulation," says BTCC analyst William. "A sustained break above 3.85 could trigger a 20-30% rally, though traders should watch the MACD crossover for confirmation."

Regulatory Winds Shift: XRP Faces Mixed Sentiment Amid Fundamental Developments

While Ripple's RLUSD stablecoin earned a top-tier rating (boosting institutional confidence), XRP faces headwinds from SEC delays and large wallet movements. The 50% surge on regulatory clarity contrasts with 10% drops from whale transfers.

"This is classic XRP," notes William. "The network upgrades and DeFi yield opportunities (20% APY) create long-term value, but ETF delays and lawsuit FUD will cause volatility. The $3 support level is critical."

Factors Influencing XRP's Price

Ripple's RLUSD Stablecoin Earns Top 'A' Rating from Bluechip, Bolstering Market Confidence

Ripple's USD-pegged stablecoin RLUSD has achieved an 'A' rating from Bluechip, the highest possible assessment for digital assets. The evaluation reflects exceptionally low market risk, with stability (0.91), governance (0.86), and management (0.84) scores all landing in the top tier. This endorsement signals institutional-grade trust in Ripple's stablecoin infrastructure.

The rating follows strategic moves to strengthen RLUSD's foundation. Ripple partnered with OpenPayd for direct minting/burning capabilities, while BNY Mellon serves as official custodian for dollar reserves. These measures ensure liquidity management meets institutional standards under the stringent oversight of New York's financial regulator.

Bluechip's validation positions RLUSD as a formidable player in cross-border payments. The scores reflect Ripple's success in balancing regulatory compliance with technical innovation—a combination that's becoming increasingly crucial as stablecoins evolve beyond speculative assets into financial infrastructure.

XRP Drops 10% Amid SEC ETF Delay, Ripplecoin Mining Launches Cloud Contracts

XRP fell sharply to $3.18 on July 23, a 10% drop attributed to regulatory uncertainty rather than on-chain issues. The SEC's sudden postponement of the Bitwise Crypto Index Fund ETF conversion—despite earlier signals of acceleration—triggered broad market anxiety, dragging down XRP and other major cryptocurrencies.

Ripplecoin Mining countered the volatility by unveiling XRP cloud mining contracts, offering holders a way to generate yield during price swings. "Holding currency to earn interest" now becomes a viable strategy amid turbulent markets.

Analysts note the decline reflects deeper structural pressures. Regulatory whiplash and institutional hesitation continue to dictate short-term crypto asset performance, with XRP serving as a bellwether for broader sector sentiment.

Analyst Claims 500 XRP Could Transform Lives Amid Bold Price Targets

Crypto analyst Edoardo Farina has revised his stance on XRP holdings, now suggesting that just 500 tokens could yield life-changing returns. The founder of Alpha Lions Academy previously advocated for 10,000 XRP as a minimum threshold for financial freedom but now believes a smaller position could prove equally transformative.

Farina maintains an unshakable $100 price target for XRP, a level that would value 500 tokens at $50,000. This projection comes as the asset trades near $3.20, with other analysts like EGRAG forecasting more conservative targets around $27 per token. The revised outlook reflects growing confidence in XRP's long-term appreciation potential despite current market conditions.

The debate over XRP's valuation continues as proponents highlight its utility in cross-border payments while critics point to regulatory hurdles. Farina's unwavering position—refusing to sell below triple digits—signals deepening conviction among crypto's true believers.

Retail XRP Holders Gain Access to 20% Yield Through DeFi Protocol

MoreMarkets has introduced an XRP Earn Account, enabling retail investors to participate in yield strategies previously limited to institutional players. The product targets idle XRP holdings, estimated as a multibillion-dollar opportunity, by offering curated DeFi strategies with self-custody—a first for the XRP ecosystem.

The protocol routes deposits into audited smart contract vaults, automating capital deployment across vetted strategies while preserving user control. Security audits were conducted by Halborn, Sherlock, and Sigma Prime, with onboarding simplified via email or wallet connections.

"We're merging fintech accessibility with DeFi's yield potential," said Altan Tutar, CEO of MoreMarkets. "Retail investors have been stuck with sub-2% returns while institutions accessed 20%+ yields." The solution utilizes cross-chain infrastructure similar to wrapped assets like WBTC.

XRP Price Plummets 10% Amid $140M Transfers Linked to Ripple Co-Founder

XRP's price tumbled more than 10% in 24 hours, breaching critical technical support levels as large transfers from wallets tied to Ripple co-founder Chris Larsen sparked a sell-off. Blockchain data reveals $140 million worth of XRP moved to exchanges since July 17, triggering $81.7 million in futures liquidations.

Trading volume surged nearly 150% as bearish momentum accelerated, with South Korea's Upbit exchange accounting for over 75 million XRP sold. The transfers, first flagged by investigator ZachXBT, have raised questions about potential coordinated selling pressure from Ripple-affiliated addresses.

XRP Lawsuit Timeline Disputes Ripple-BlackRock Conspiracy Theory

Speculation about a clandestine partnership between Ripple and BlackRock has surged on social media, with proponents alleging the XRP lawsuit was a staged maneuver to benefit both entities. Former SEC attorney Marc Fagel refuted these claims, clarifying the litigation began under former SEC Chair Jay Clayton—not Gary Gensler. Legal analysts dismiss the conspiracy, emphasizing the lawsuit’s standalone nature.

Ripple’s infrastructure push continues unabated, with the XRP Ledger evolving to accommodate tokenized assets like treasuries and real estate. This strategic pivot mirrors institutional trends, notably BlackRock’s own tokenization initiatives. A recent collaboration with ONDO Finance underscores Ripple’s deepening foothold in on-chain financial products.

Fact Check: No Evidence Supports BlackRock-Ripple Merger Claims

Speculation about a potential merger between BlackRock and Ripple has surged across crypto communities, fueled by unverified claims from an on-chain analyst known as Atlas. The analyst cited "leaked documents" suggesting alignment between the two firms' objectives, but provided no tangible evidence.

Neither BlackRock nor Ripple has confirmed any discussions or agreements. Major financial and crypto news outlets have similarly reported no such developments. XRP's market presence continues to grow, yet these rumors remain firmly in the realm of speculation.

Ripple's recent hiring activity hints at expansion, but ties to institutional giants like BlackRock are purely conjectural. Market participants should treat such claims with caution until verified by official channels.

Ripple (XRP) Surges Over 50% Amid Regulatory Clarity and Institutional Adoption

XRP has rallied more than 50% since early July, breaching key resistance levels to trade above $3.60. The surge reflects a confluence of bullish catalysts—regulatory tailwinds, institutional infrastructure growth, and technical breakouts—positioning XRP as a standout altcoin for wealth creation.

Regulatory momentum accelerated in March when Ripple settled its SEC case for $50 million, avoiding a security classification for public trading. The resolution removed a major overhang, restoring confidence among U.S. exchanges and institutional investors. By May, CME Group launched XRP futures, while ProShares and Canadian issuers rolled out ETFs, unlocking mainstream capital flows.

Ripple’s CBDC infrastructure is gaining traction globally, with central banks testing private ledgers. This real-world utility further embeds XRP in financial systems, reinforcing its bullish thesis.

XRP Rebounds From Nearly $3 After 10% Drop, Signals Possible Bottom

XRP plunged 10.14% in a 24-hour window, tumbling from $3.45 to $3.10 before finding a floor at $2.96. The sell-off intensified as it breached the $3.20 support level, establishing new resistance between $3.23 and $3.25. Trading volumes surged to 175 million—well above average—hinting at institutional accumulation during oversold conditions.

A swift recovery followed, with prices climbing from $3.06 to $3.11 in the session's final hour on elevated volume. The rebound formed a sequence of higher lows, suggesting a potential bullish reversal. Analysts interpret this price action as institutional buyers stepping in at discounted levels.

How High Will XRP Price Go?

Based on current technicals and news sentiment, XRP could rally toward 4.50-5.00 USDT by Q3 2025 if it holds above key supports:

| Scenario | Price Target | Condition |

|---|---|---|

| Bullish | 5.20 USDT | MACD golden cross + ETF approval |

| Base Case | 4.30 USDT | Hold 3.00 support + RLUSD adoption |

| Bearish | 2.50 USDT | SEC lawsuit escalation |

William emphasizes: "The 20-day MA at 2.9268 acts as a dynamic floor. With institutional products launching and the MACD potentially flipping positive, our 6-month outlook remains constructive."